Snapshot of the game

Snapshot of the current rules of the game, July 20, 2024.

Snapshot: July 20, 2024. This is the current state of the game. I will be updating this as mechanics and content change leading up to V1.

How to play

Swagger is a tabletop game where players compete to build the most successful venture capital fund. The game is for 2-8 players but it can also be played in large groups for events or classrooms (with multiple game sets).

From a starting pool of capital, players plan their strategies, invest in the best startups, and make difficult decisions. The fund that makes the most money wins.

No knowledge of startups, venture capital or finance is needed to play Swagger.

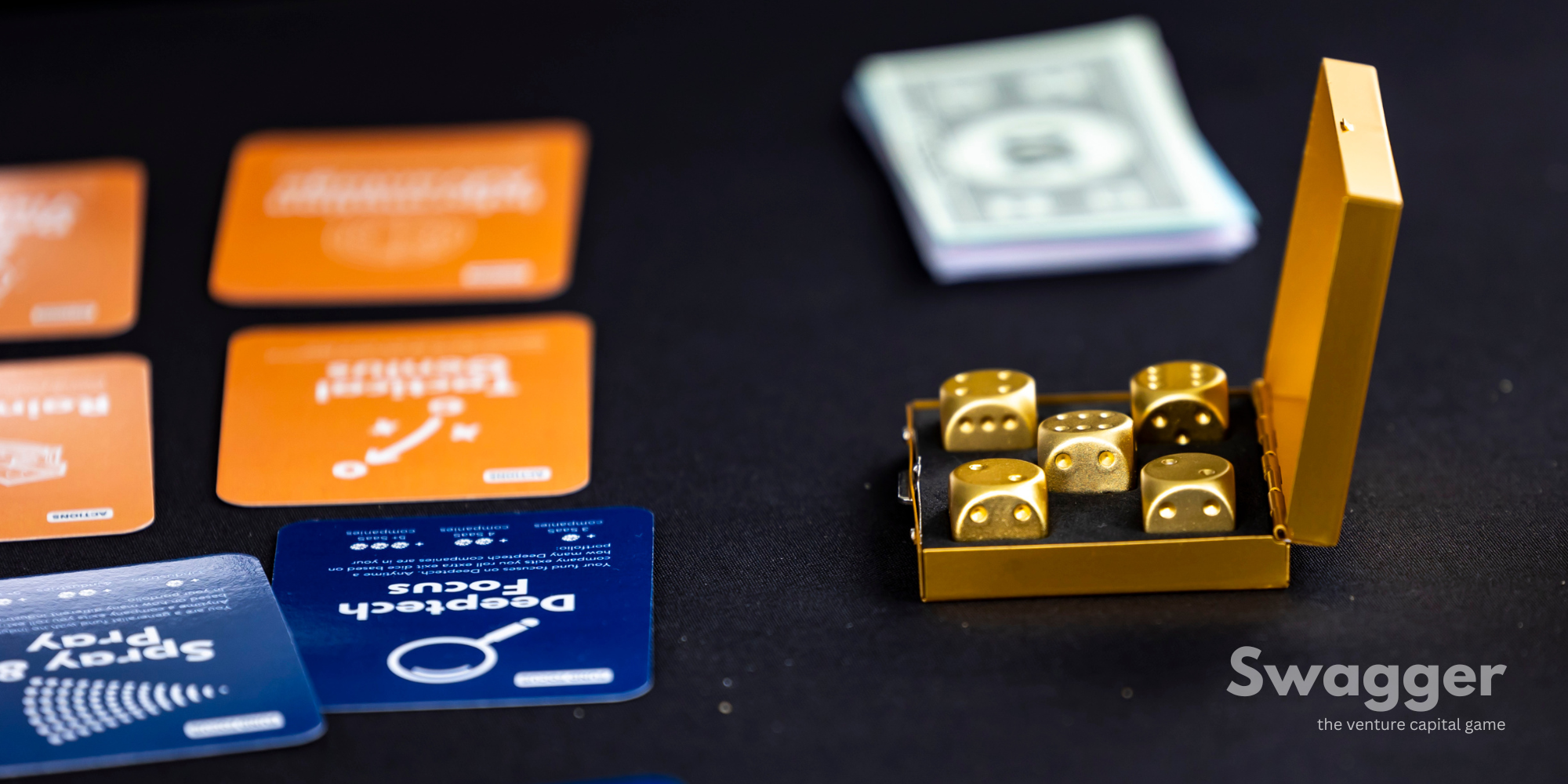

In the box

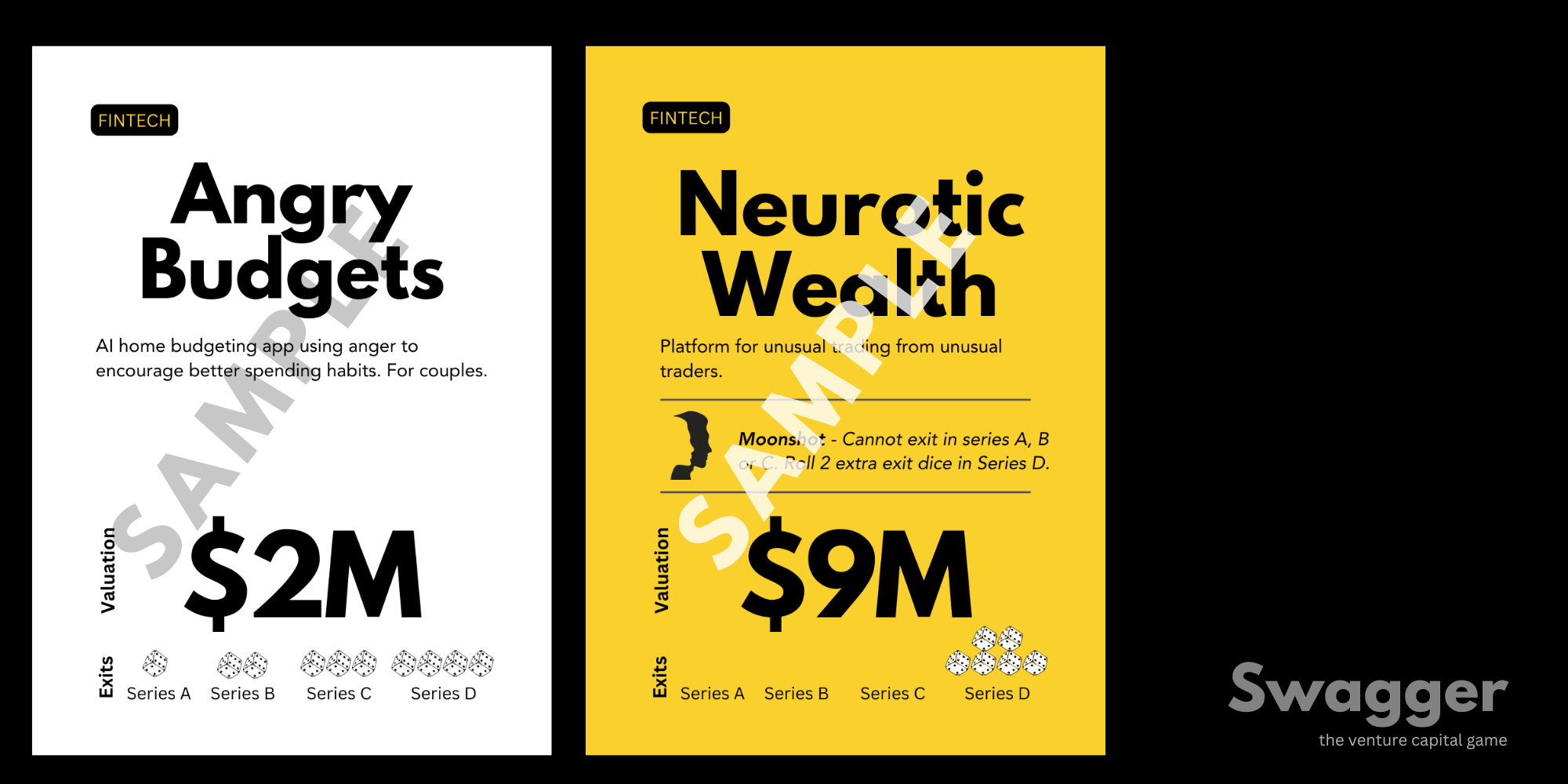

- Company cards with valuation, industry, and different characteristics

- Event cards that introduce random events

- Industry News cards that affect all players

- Fund Focus cards that allow players to pick their own strategy

- Special Action cards that give players special abilities that can be used once

- Fundraising cards (Series A, B and C with different features)

- Money

- Dice

Gameplay:

There are three main phases in Swagger: creating the fund, managing investments, and scoring.

Creating the fund

Each player receives the same amount of money, eg $100M. The difficulty of the game can be adjusted by reducing the size of the fund or increasing/reducing the total number of companies in the portfolio.

In this phase players choose their fund focus, eg they can concentrate on one industry or diversify. Each type of strategy has benefits. Eg a player that chooses a FinTech focus gets bonuses the more FinTech companies they own.

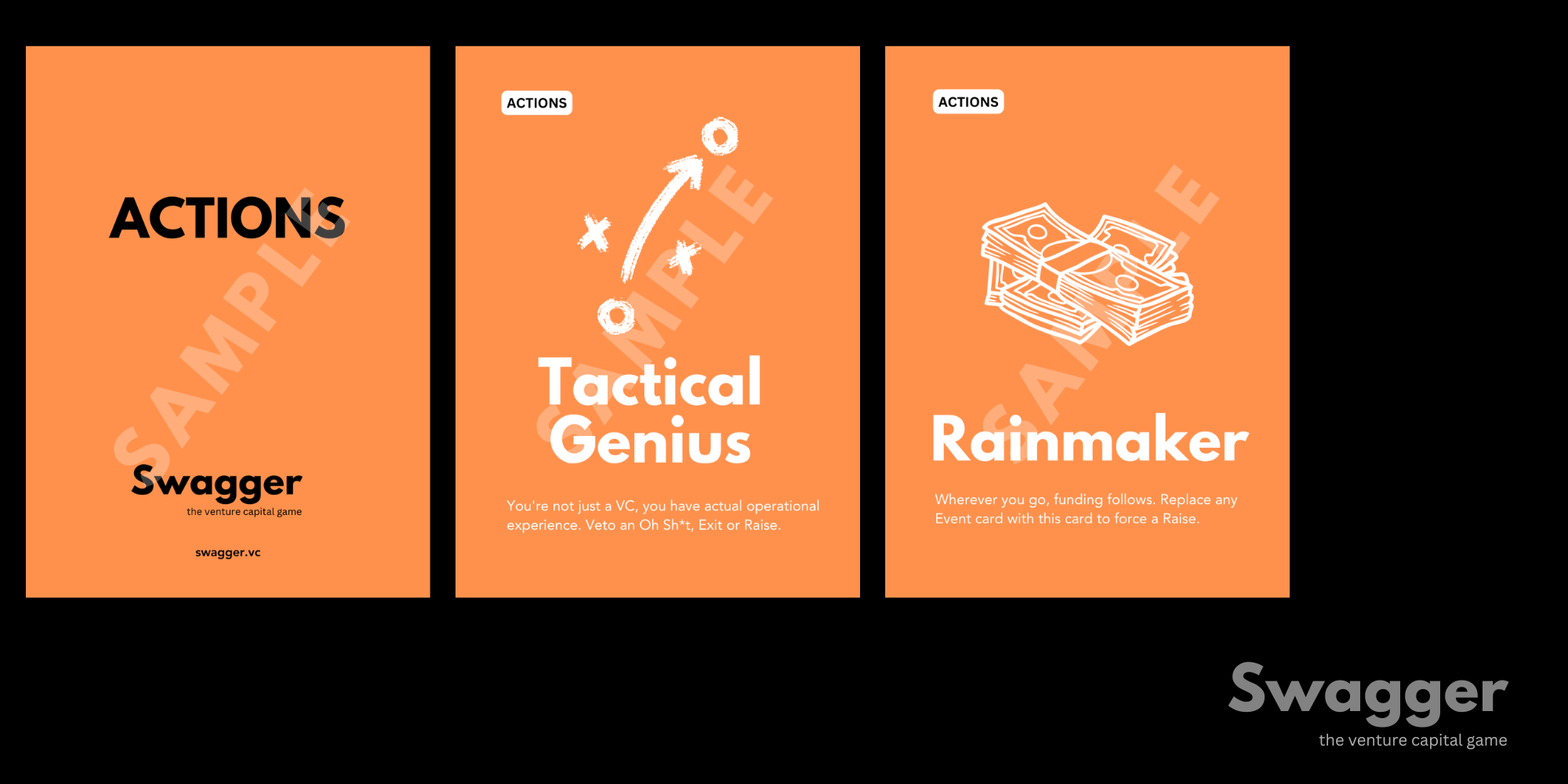

Next, players choose one or more Action cards, which are a unique abilities they can use once per game. Eg Self-Declared Visionary lets players see the next Industry News card. Some cards, like Cramdown, can be played against other players.

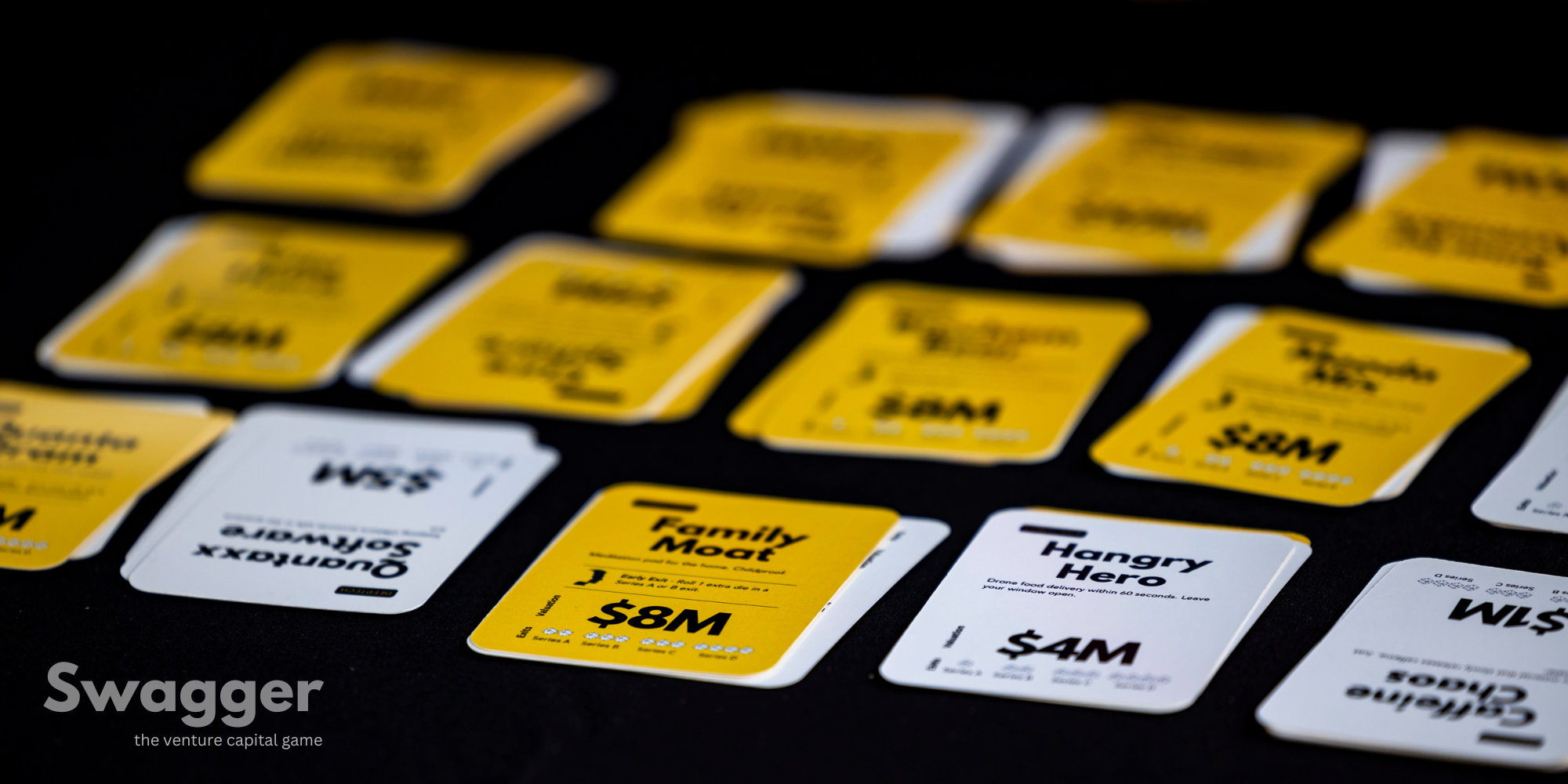

The final step of fund creation is choosing which companies to invest in. Each company is unique so players compete to invest in the companies that are best suited for their chosen strategy.

During this phase, some cards are face down and others are face up. Each player can take two actions: taking a card or revealing a card. This means a player can make two investments per turn, if they find two companies they like. Or they can reveal two cards, if they don't like the selection available.

Currently, portfolios are 6-8 companies.

This phase ends when all players have built their portfolios.

Managing Investments

The next phase of the game is about managing the companies in the portfolio and dealing with external events, including the actions of other players.

This is played over 8 turns, simulating 8 years of a fund's life.

Industry news

At the beginning of each turn/year, one Industry News card is turned over. This reveals positive and negative effects that occur to specific industry, eg a Deeptech industry freeze.

Company events

Next, players turn over one Event card per company they own. Events reveal what happened to the company in that year. Eg nothing, fundraising, or it goes bankrupt.

Fundraising

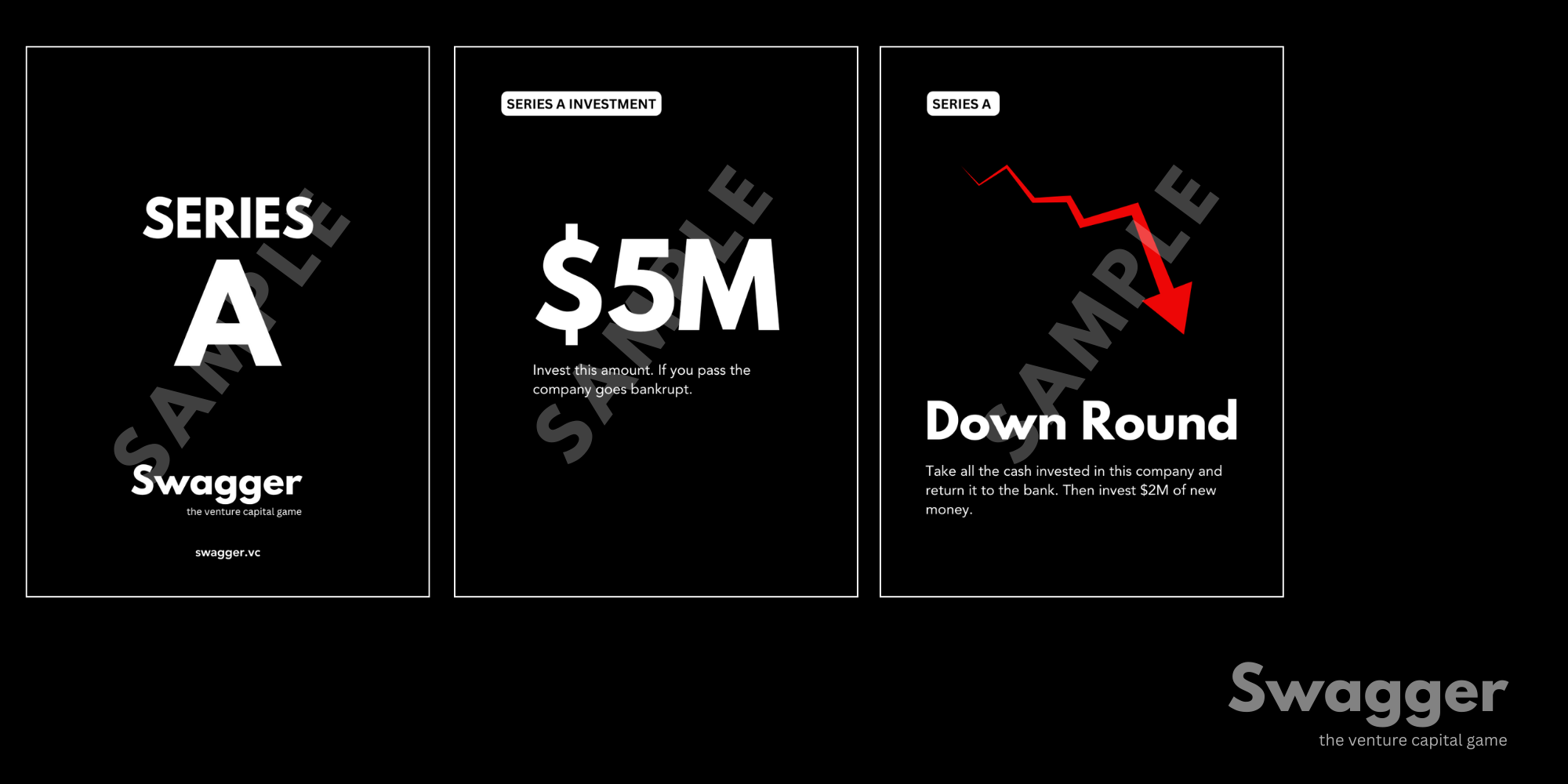

Players can only invest when a company is fundraising. Companies first raise Series A funding, then Series B and finally Series C. When fundraising, the players turns over the Series A, B or C card and invests the amount shown. If they choose not to invest, or cannot, that company goes bankrupt.

After that the companies Exit, meaning they are acquired or IPO. Exits are the only way funds can make money.

During fundraising a company can have a Downround or an early Exit.

Exits

Exits happen during fundraising or after a company has raised 3 rounds of funding. Swagger uses dice to calculate the return on investment. Eg an exit at the first round (Series A) means the player rolls one die. This is the return multiple. Return on investment is calculated by totalling the rolls of exit dice and multiplying by the total cash invested.

Sample calculation:

- $10M total invested

- Series C exit, 3 dice to roll

- The player rolled 3 dice and got 10

- ROI = $10M X 10 = $100M (including the $10M initially invested)

The later the exit the higher the multiple. Eg an exit at Series B means roll two dice, at Series C roll 3 dice. Industry events, special Company cards and special Actions can all affect the number of dice rolled at exit. The strategy is to roll the most dice at exit.

Strategy

One of the key strategies of Swagger is to balance how much to invest up front vs how much to save for later. Spending too much early may mean running out of "dry powder" which could result in companies going bankrupt. Saving too much is not a good strategy because that money will have zero return on investment.

It is also a good strategy to maximize the benefit of the fund strategy chosen, eg choosing companies in the industry you are focusing on.

Action cards introduce player vs player dynamics that are unpredictable and can greatly affect outcomes.

Scoring

After 8 rounds players count the cash in their fund account. This is their final score and the highest score wins.

Note that only companies that have achieved exits return cash. All cash left "on the table" is discarded. Players usually call those "unrealized returns" to make themselves feel better.